The New Year Brings Big Questions for Markets

Alex Kluesner, CFA

January 1, 2024

As we pack away the holiday decorations, we’re reminded that every new year brings fresh opportunities and challenges for our lives and our portfolios. And 2024 is no different — with uncertainty surrounding future monetary policy and a looming presidential election. Let’s look at the biggest questions ahead and the implications for your portfolio.

1. Will rates stay higher for longer?

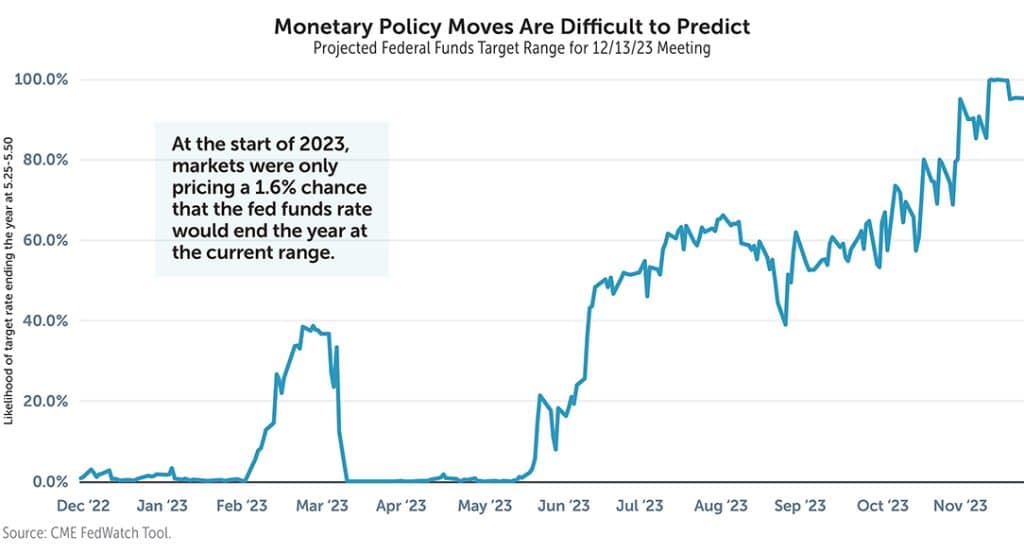

Now that the Federal Reserve appears to be finished with its rate hike campaign, investors are focused on where rates will go from here. After the Fed’s December meeting where rates were left unchanged, the federal funds rate futures markets were projecting that the Fed would start cutting rates this spring, ending in a target range of 3.75% to 4.00% by year-end 2024. But as the Fed concluded hiking rates in 2023, its official policy statement suggested that it was still premature to declare victory over inflation and that future rate hikes can’t be ruled out yet. Although history has shown that the future path of interest rates is highly uncertain, we can analyze what such a scenario would mean for the stocks and bonds in your portfolio.

2. Will the comeback for bonds continue?

In 2022, bonds suffered stomach-churning declines as the Fed raised interest rates by a whopping 4.25%. However, for those who were able to stay the course, there are tailwinds to ride as a result. First, interest rates have risen and appear to be resting firmly higher relative to pre-pandemic levels, meaning both the expected return and expected yield are now higher for most bond portfolios. Both should provide for more capital growth opportunities for your portfolio relative to the past because proceeds from maturing bonds can be reinvested at higher rates, and it’s more likely that portfolio withdrawal rates can be sustained over time.

3. Will stocks stay on a wild ride?

Interest rate movements also have direct implications for stocks. Even though the market was up almost 20% year-to-date through the end of November, we saw a 9% contraction over three months starting in August 2023 as the market accepted that the Fed will likely keep rates higher for longer. 1

What caused this autumnal pullback? The same factors that drove markets upward earlier in the year—a resilient U.S. economy and better-than-expected GDP growth—led the Fed to dig its heels in further on keeping interest rates elevated toward the end of the year and beyond. Although markets are now turning toward the possibility for rate cuts this year, which contributed to a December rally in stocks, rates will likely remain higher relative to pre-pandemic levels.

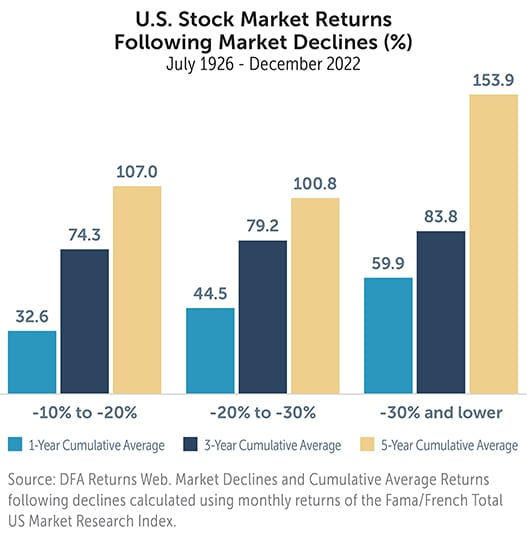

So, what would higher rates mean for stocks? It will increase the cost of financing for companies that need to issue new debt or refinance to support ongoing operations. This could have a negative impact on corporate earnings and stock prices. However, given how difficult future developments are to predict, altering your stock portfolio in response to this scenario is unwise because expectations of future performance are ever-changing. And even if stocks decline, research shows that gains can add up after big declines.

4. How unpredictable will the election year be?

In addition to potential monetary policy changes, the upcoming presidential election is also top of mind for many. With 34 Senate seats up for grabs along with all 435 House of Representatives, control of Congress also hangs in the balance. It’s important to remember that partisan control of Congress and the White House has had little impact on the economy and markets; U.S. GDP growth has continued to climb through each of the last 46 presidencies, and stocks have trended upward over the long term. 2

Markets can be susceptible to elections through policy changes. When a candidate’s proposed policies target specific market segments or regions and are expected to be impactful, affected company stocks will respond positively or negatively based on the likelihood of those policies being enacted. In 2024, candidates are likely to use the growing federal budget deficit as a platform to engage their constituents, but the likelihood of significant policies being enacted in any meaningful way is low because of competing spending priorities and prior failed attempts to raise government revenues through tax increases.

5. Will your portfolio be prepared?

As we become acquainted with the new year and the changes it brings, it’s important to view our portfolios through a long-term lens and not limit our decision-making to the next 12-month window. Like every year, one of the most important decisions you can make in 2024 is to ignore the noise and stay invested along the way to meeting your financial goals. If you’re still concerned that market events may affect your portfolio strategy and long-term plan, then you may want to have a conversation with your advisor to consider other options that would bring you more peace of mind.

1. Market returns represented by the Russell 3000 index.

2. J.P. Morgan. “2024 Elections: 3 thoughts on the year ahead.” Nov. 10, 2023.

For chart 2, the decline thresholds are defined as 1.) -10% or lower without exceeding -20%, 2.) -20% or lower without exceeding -30%, and 3.) -30% and lower. The 1-year, 3-year, and 5-year cumulative average return calculations begin in the month following the period in which the decline threshold was breached. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio nor do indices represent results of actual trading. Information from sources deemed reliable, but its accuracy cannot be guaranteed. Performance is historical and does not guarantee future results. Total return includes reinvestment of dividends and capital gains.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. R-23-6580

Alex Kluesner, CFA

Investment Strategy Manager