While social media can be a fun way to stay connected with friends and family, it does come with some financial risks. This article explains how your personal information can be at risk through your social media accounts and provides tips to protect yourself. Did you know that around 60% of the global population uses...

Director of Family Budget Services Rob Bertman shares his best tips to help you buy gifts for your loved ones…

Marrying in retirement may come with tax, estate planning and financial ramifications....

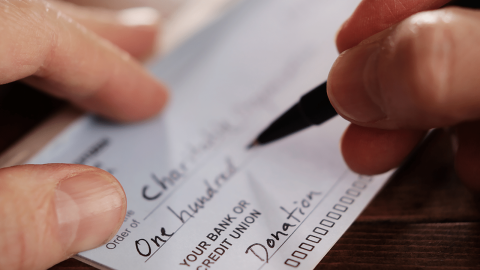

Wealth Advisor Tad Gray shares steps you can take to prepare your gifting intentions.

New RMD regulations will introduce some big changes for those who own retirement accounts and are required to take withdrawals.

Planning early for a business transition can make all the difference for your financial plan. Business Solutions Director Chuck Laverty…

A well-executed estate plan contains many moving parts that should align with your ever-evolving unique goals and circumstances. Read More...

While starting a new job is exciting, it’s important to be prepared for how your financial life could change.

Many individuals approaching retirement are struggling with the question, “Am I ready to retire or should I continue working?"

Out-of-pocket travel costs can have a big impact on our finances. Wealth Advisor Susan Chesson shares why you should not…

If you have a trust as part of your overall estate plan, hiring a professional trustee can offer valuable benefits.

Director of Family Budget Services Rob Bertman shares tips on creating an effective budget and how to stick to it.